Buying Property in a Rising Market: What You Need to Know

admin February 27, 2026 Buying Property in a Rising Market: What You Need to Know Expert Guidance from Ash Buyers...

admin

September 16, 2025

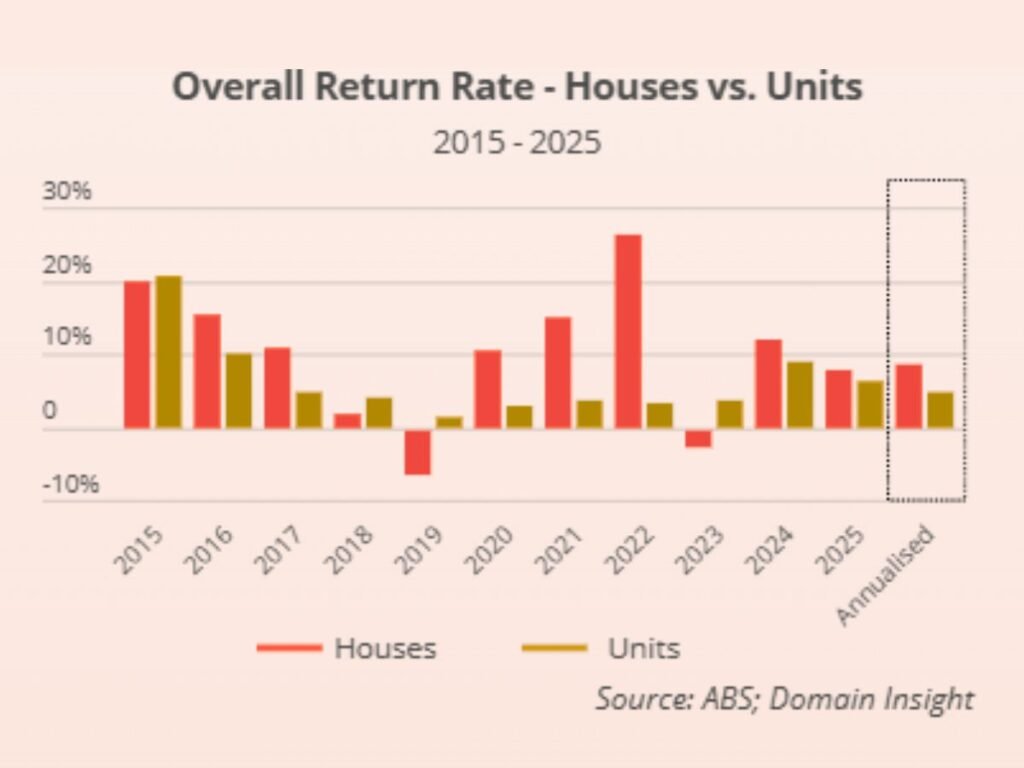

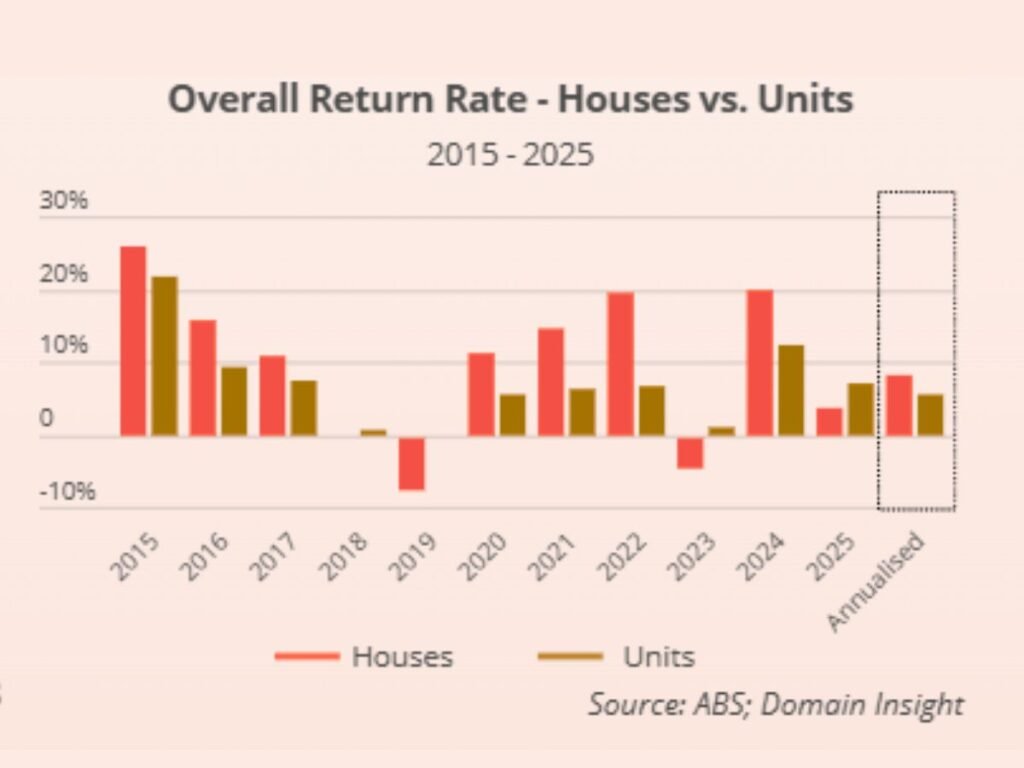

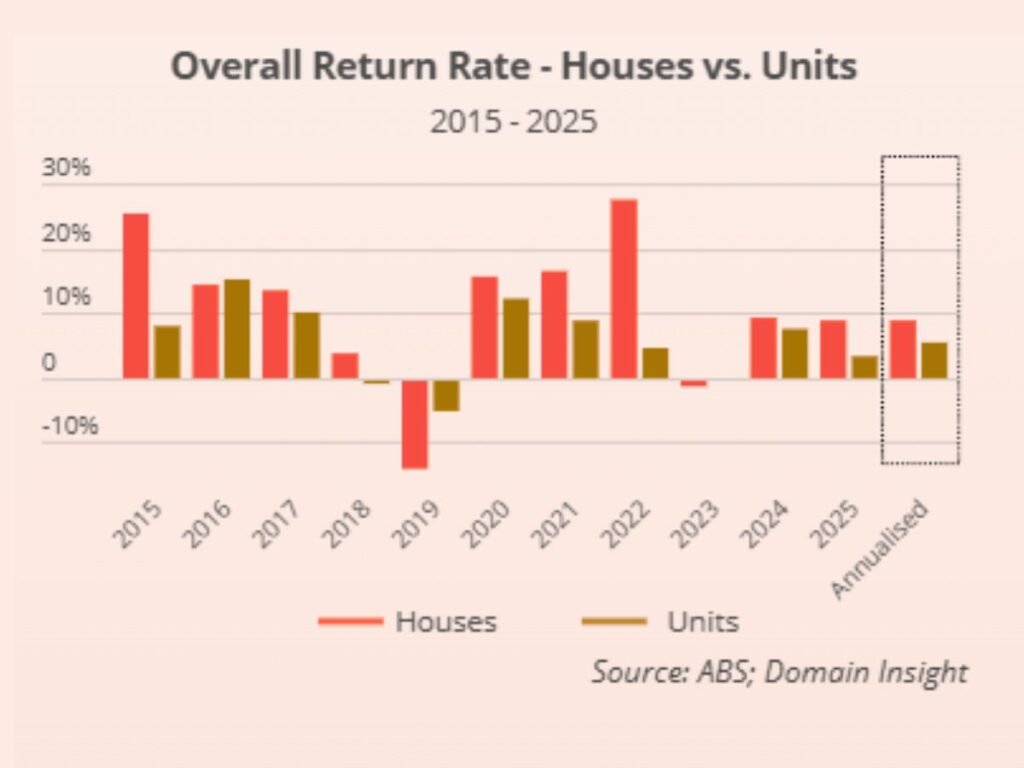

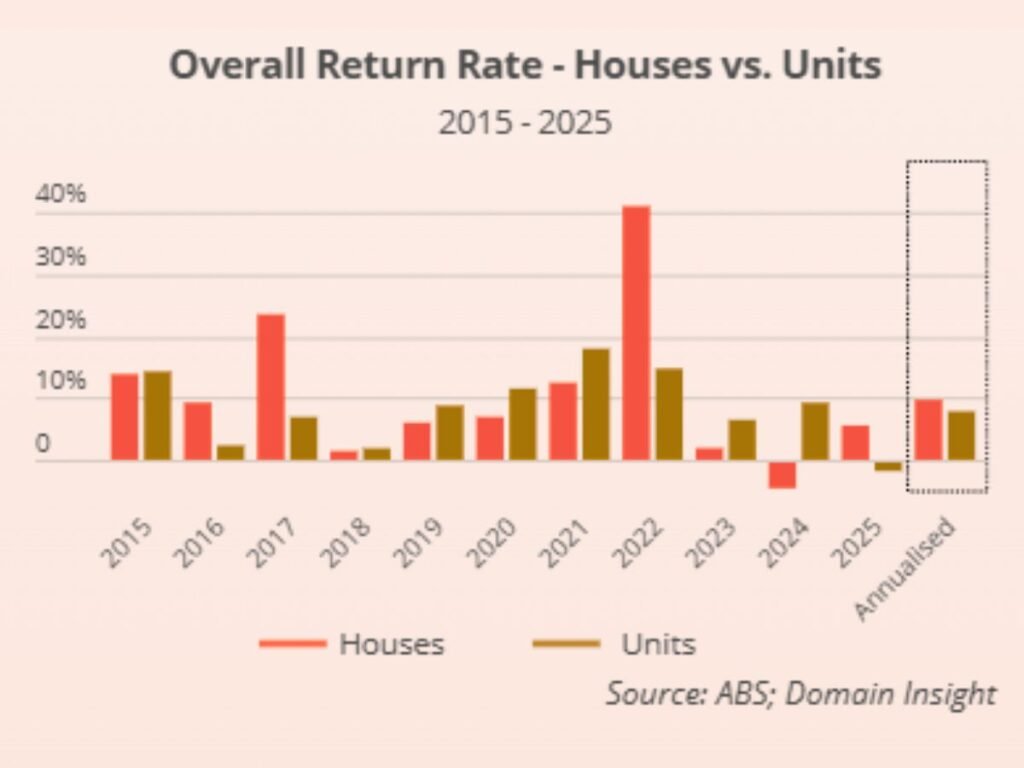

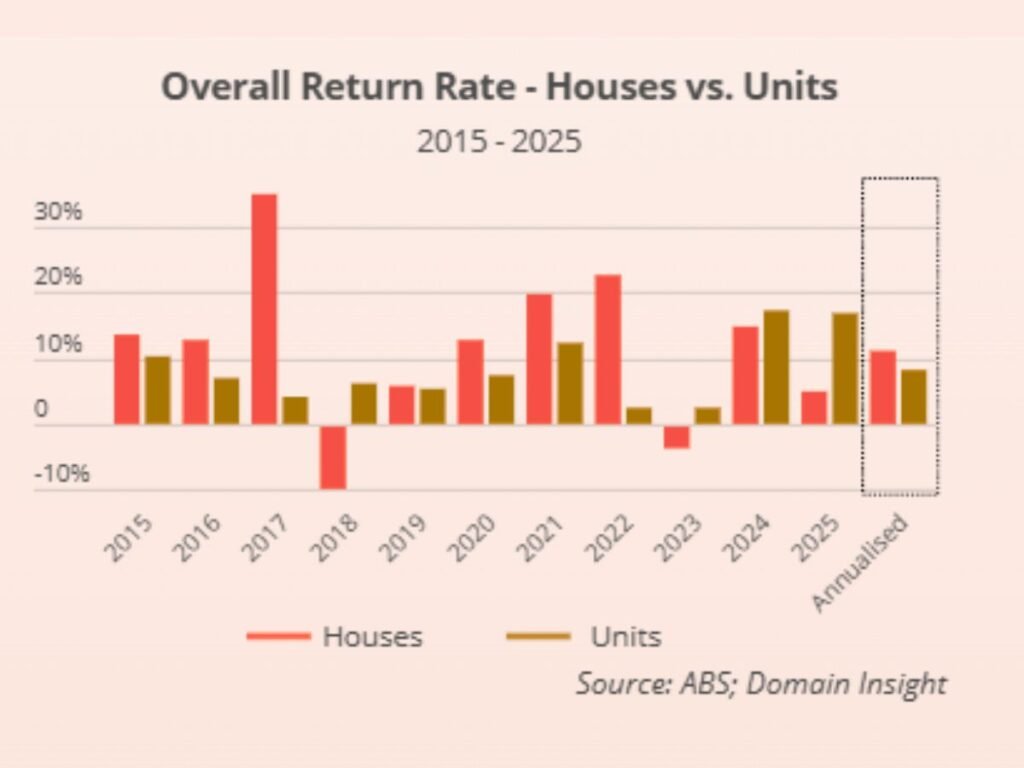

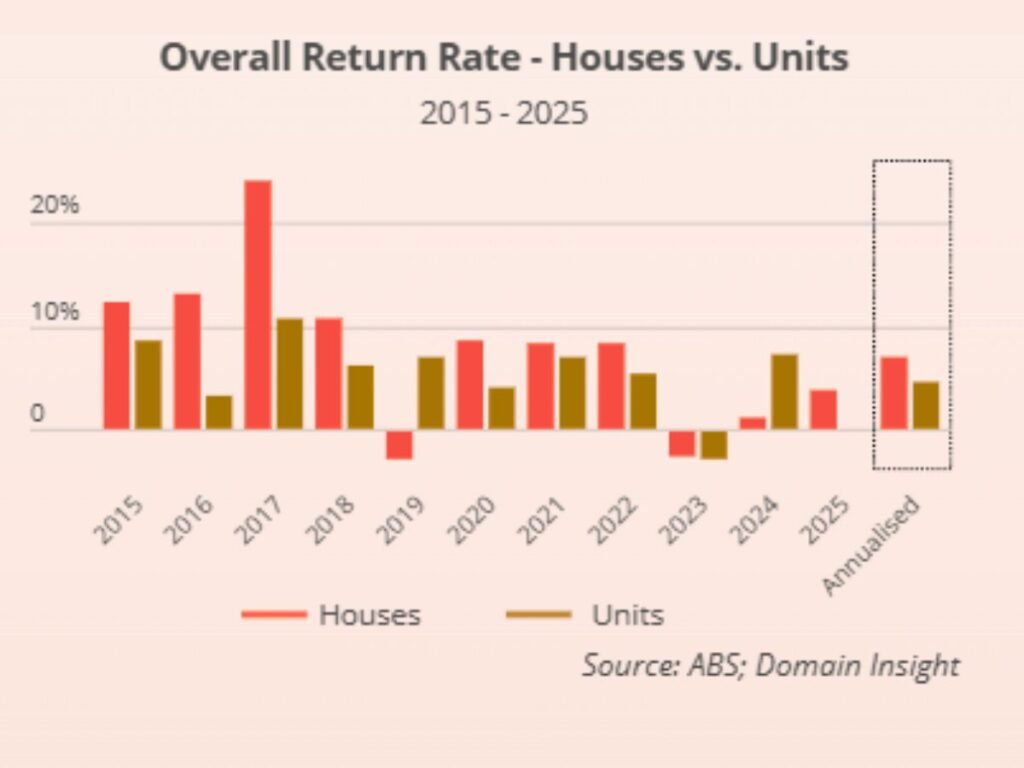

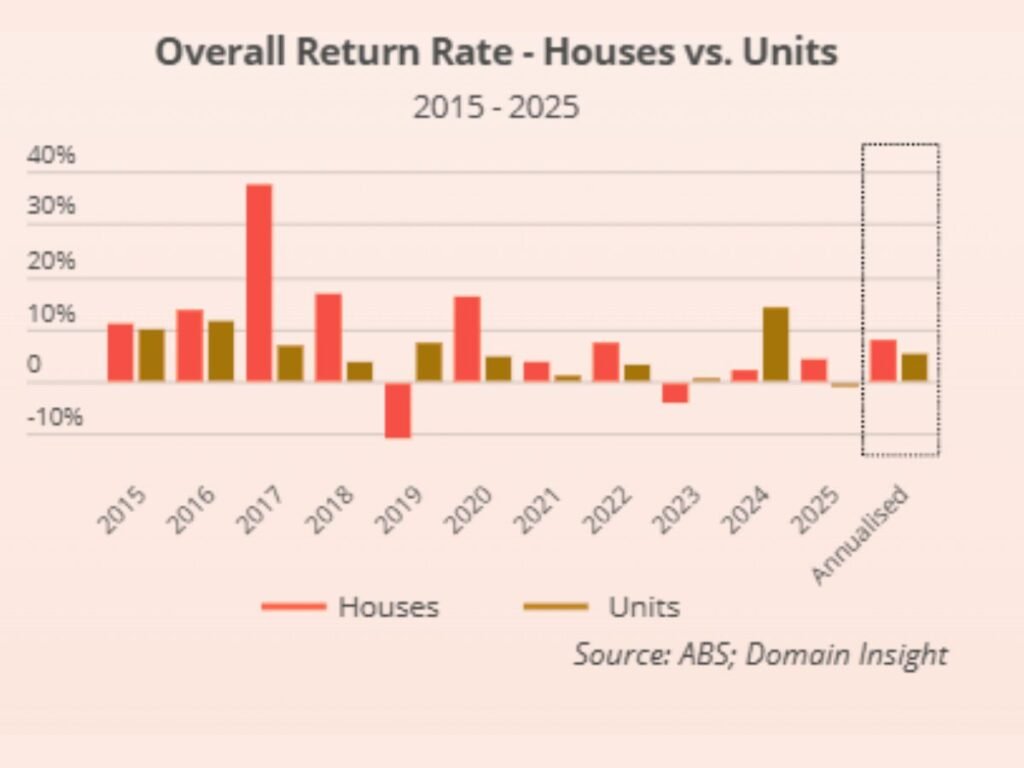

Australia’s property market is a beast of its own, but within it, a fascinating and growing chasm has emerged between the value of houses and units. While houses have consistently outperformed units for years, recent affordability pressures and changing buyer preferences are starting to reshape the landscape. However, the disparity in growth remains immense in specific regions, presenting both a challenge for aspiring homeowners and a potential opportunity for investors.

At Ash Buyers Agency, in this blog guide, here 7 regions in Australia revealing the largest and most significant differences in growth between houses and units.

Oversupply Slows Value Growth While Rentals Hold Steady, but Returns Lag

Parramatta saw strong growth in unit approvals throughout the 2010s, while approvals for houses remained consistently low.

Units have shown relatively solid rental growth, just 6% less than the growth seen in houses.

Oversupply Slowed Value Growth, While Rentals Outperformed, but Returns Still Lagged

Over the last ten years, unit building approvals in Strathfield, Burwood, and Ashfield have typically outpaced house approvals, with 2022 being the notable exception.

Apartments in the Strathfield, Burwood, and Ashfield areas have outperformed houses in the rental market, with rents increasing at a slightly faster pace.

Oversupply Slowed Value Growth as Rentals Outperformed but Returns Still Lagged

Although showing a downward trend, unit building approvals in Ryde-Hunters Hill have remained consistently high over the past decade, significantly outpacing approvals for houses.

Apartments in Ryde–Hunters Hill have shown stronger rental growth than houses, with rents increasing at a quicker rate. This trend is largely driven by the addition of new apartment developments, where higher rental prices have lifted the overall median.

Oversupply Slowed Value Growth, with Rental Growth Lagging Despite Higher Yields

During the 2010s, South Canberra experienced high and fluctuating unit building approval rates. However, from 2022 onward, these approvals have become much lower and more stable. In contrast, house approval rates have remained consistently low across the entire period.

House rentals in South Canberra have grown n around 30% more than unit rentals over the past decade.

Oversupply Slowed Value Growth, Rentals Outperformed but Returns Still Lagged

Over the past decade, unit approvals in Brisbane’s inner suburbs have been considerably higher than those for houses, which have remained persistently low.

In Brisbane’s inner suburbs, units have outperformed houses in the rental market, recording rental growth around 50% higher over the past decade.

Oversupply Slowed Value Growth, Rentals Outperformed but Returns Lag

Approval rates for unit developments in Yarra have remained high for most of the past decade, while approvals for houses have stayed consistently low and steady.

Apartments in Yarra have recorded stronger rental growth, rising at about 1.25 times the pace of houses.

Oversupply Slowed Value Growth, Rentals Outperformed but Returns Lag

In the past decade, unit building approvals in Melbourne City have consistently outpaced house approvals, although they have dropped noticeably in recent years.

Even though capital growth has been slower, Melbourne City units have outperformed houses in rental returns, with rents rising around 40% more over the past decade.

The gap between house and unit growth in Australia isn’t just a set of statistics; it’s a reflection of changing buyer behaviour, lifestyle priorities, and market dynamics. Sydney’s record-breaking disparities to each region tell a story of how demand for space, affordability, and long-term value plays out differently across the country.

For homeowners, these gaps highlight the affordability challenges of entering the housing market. For investors, they present a choice: pursue the long-term capital growth typically offered by houses, or target units in areas where affordability pressures may drive demand upward in the future.

No matter which path you take, the lesson is clear: understanding regional performance differences is critical to making informed, strategic decisions in today’s property market.

At Ash Buyers Agency, we specialise in helping investors and homebuyers navigate Australia’s ever-changing property market. Whether you’re weighing up houses vs units or exploring the best regions for growth, our team is here to guide you.

As a trusted buyer’s agent in Sydney, we provide expert insights, tailored strategies, and on-the-ground support to secure the right property for your goals. Call us today at +61 434 111 200 and let’s discuss your next move.

Follow us on Facebook and Instagram for property tips, market updates, and insider advice you won’t want to miss!

admin February 27, 2026 Buying Property in a Rising Market: What You Need to Know Expert Guidance from Ash Buyers...

admin February 23, 2026 Buying Off the Plan: A Smart Entry Strategy for First Home Buyers Stepping onto the property...

admin February 16, 2026 Why Thinking Long-Term Pays Off When Buying Property Many property buyers enter the market focused on...

Buying your first home or interstate investment might seem hard, but with Ash Buyers Agency, we make it easier. We help, educate and execute making the process simple and rewarding for our clients.

© 2026 · Ash Buyers Agency. All rights reserved. It is illegal to reproduce or distribute copyrighted material without the permission of the copyright owner.