Buying Property in a Rising Market: What You Need to Know

admin February 27, 2026 Buying Property in a Rising Market: What You Need to Know Expert Guidance from Ash Buyers...

admin

August 13, 2025

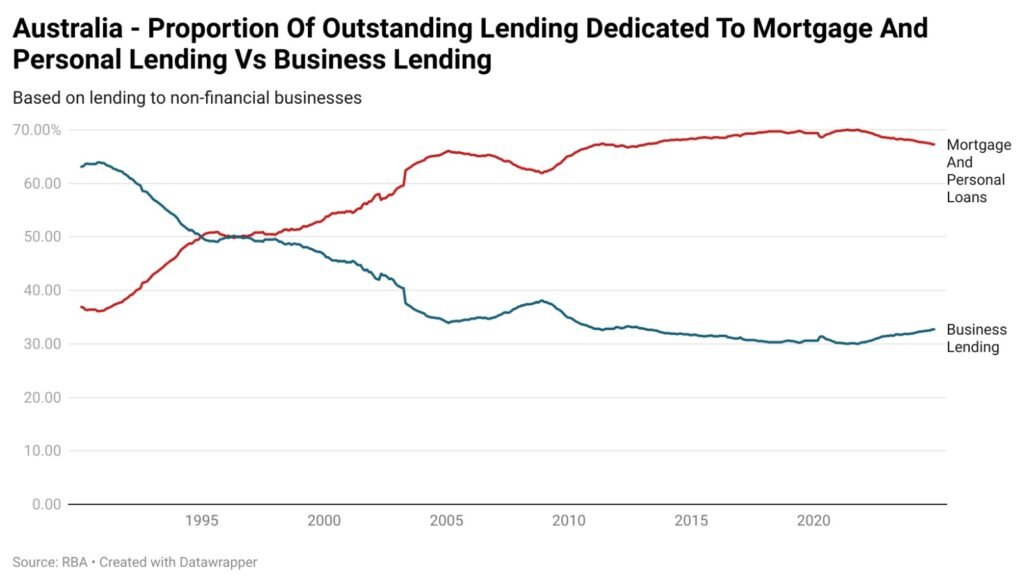

Over the last 30 years, Australia has seen a dramatic transformation in lending priorities, one that every smart investor and buyer’s agent should pay close attention to. In the early 1990s, business lending dominated the financial landscape, accounting for roughly 65% of outstanding credit. Mortgages and personal loans made up less than 35%.

Today, the script has flipped. Mortgage and personal lending now make up nearly 68%, while business lending has dipped to just over 32%, according to the Reserve Bank of Australia. This shift signals a national pivot from backing entrepreneurial growth to fuelling residential property demand, a development with serious implications for those building wealth through real estate.

For buyer advocates, this trend highlights Australia’s growing reliance on the housing market as a key economic driver. Capital that once helped businesses grow is now being poured into the property sector, fuelling rising prices and competition.

If you’re an investor seeking off-market properties in Sydney. This environment presents a double-edged sword. On the one hand, increased demand can boost property values. On the other hand, finding good deals requires the insight of a skilled buyer’s agent who can navigate a crowded and competitive market.

In a market this saturated, having a buyer’s advocate on your side is more important than ever. The best buying agents don’t just wait for listings to hit the public market; they dig into off-market opportunities that most investors never even hear about. A top investment buyer’s agent understands how to position you for long-term capital growth while identifying properties with solid rental returns.

Whether you’re an owner-occupier or building a portfolio, working with an experienced property buyers advocate ensures data, strategy, and access back your investment decisions.

Australia’s shift in lending priorities is more than just a statistic; it’s a window into how the property market is reshaping our economy. For savvy investors, it’s also a call to act. In a climate where property is king, aligning yourself with a seasoned buyer’s agent can mean the difference between a good deal and a great one.

For tailored property advice and access to exclusive off-market opportunities, get in touch with Ash Buyers Agency today. Call us on +61 434 111 200 to speak with a professional buyer’s agent who understands how to secure positive cashflow properties and build long-term wealth through strategic property investment.

admin February 27, 2026 Buying Property in a Rising Market: What You Need to Know Expert Guidance from Ash Buyers...

admin February 23, 2026 Buying Off the Plan: A Smart Entry Strategy for First Home Buyers Stepping onto the property...

admin February 16, 2026 Why Thinking Long-Term Pays Off When Buying Property Many property buyers enter the market focused on...

Buying your first home or interstate investment might seem hard, but with Ash Buyers Agency, we make it easier. We help, educate and execute making the process simple and rewarding for our clients.

© 2026 · Ash Buyers Agency. All rights reserved. It is illegal to reproduce or distribute copyrighted material without the permission of the copyright owner.