How to Find the Right Location for Your Investment

admin January 28, 2026 How to Find the Right Location for Your Investment Expert Property Location Tips from ASH Buyers...

admin

October 28, 2025

As a property investor in Sydney, you’re looking to build wealth. But once you start your research, you’re faced with the age-old question: Should I chase

The answer isn’t a simple “A or B.” It depends entirely on your financial goals, cash flow position, and stage of life.

At Ash Buyers Agency, we help Sydney investors move past the generalizations and develop a bespoke strategy. Here is our breakdown of the Capital Growth vs. Rental Yield debate in the Sydney market.

Simply put:

Here’s a quick side-by-side comparison:

Investment Type | Definition | The Goal |

Capital Growth | The increase in a property’s market value over time. | Long-term wealth accumulation and building equity. |

Rental Yield | The annual rental income a property generates, expressed as a percentage of its value. | Strong, immediate cash flow to cover expenses. |

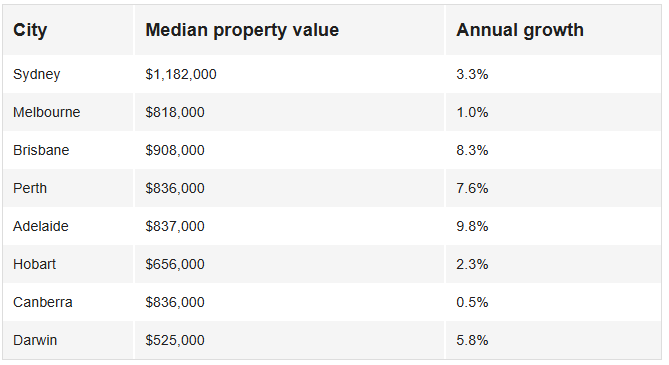

Here’s how median house prices in capital cities changed over the year to June 2025:

It’s important to know that if your property costs more than the rental income you receive, you will need to cover the difference from your own funds. Ash Buyers Agency, a Sydney buyers’ agent.

This can be challenging if your cash flow is limited.

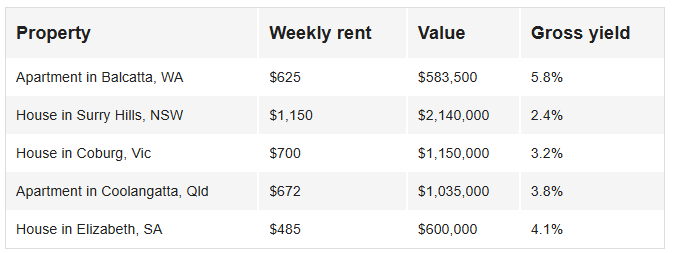

Investors who focus on rental yield are after one thing: steady income each month rather than potential future profits from capital growth.

The rent they receive helps cover expenses and, in some cases, creates extra cash that can be reinvested.

Choosing between capital growth and rental yield depends on your individual goals and circumstances. There is no one-size-fits-all approach.

It all comes down to your strategy, personal situation, and what you want to achieve, says Cate.

With that in mind, here is a quick guide to the types of investors who often benefit from focusing on yield versus capital growth.

Several additional factors can affect whether investing for capital growth or rental yield makes more sense, including:

Instead of asking which one is better?, start by asking yourself these key questions:

A smart investment strategy usually aims to achieve both growth and income. This balanced approach helps manage risk while staying aligned with your financial goals.

“Investors should start thinking about their strategy early and decide what they hope to achieve from this journey,” says Carmel Jarvis, Home Loan Specialist at Westpac.

Capital growth and rental yield can work together. Successful investors often begin with high-growth properties to build equity and later include cash-flow-positive properties to create financial stability.

What truly matters is having a clear strategy, assessing the numbers using realistic interest rates and potential vacancy periods, and choosing a property you can comfortably afford to hold.

At Ash Buyers Agency, we help you make informed, data-driven property decisions that align with your financial goals. Whether you’re chasing capital growth, rental yield, or a balance of both, our expert Sydney buyers agents guide you every step of the way from research to acquisition. Get in touch today to discuss your investment goals.

Follow us on Facebook and Instagram for expert property insights, market updates, and real stories of Sydney investors achieving long-term success!

admin January 28, 2026 How to Find the Right Location for Your Investment Expert Property Location Tips from ASH Buyers...

admin January 24, 2026 How to Choose the Right Buyer’s Agent in Sydney for Investment Property Investing in property in...

admin January 24, 2026 Buying Off-the-Plan vs. Established Property: Which Is the Better Investment? By Ash Buyer’s AgencyInvesting in property...

Buying your first home or interstate investment might seem hard, but with Ash Buyers Agency, we make it easier. We help, educate and execute making the process simple and rewarding for our clients.

© 2026 · Ash Buyers Agency. All rights reserved. It is illegal to reproduce or distribute copyrighted material without the permission of the copyright owner.