Buying Property in a Rising Market: What You Need to Know

admin February 27, 2026 Buying Property in a Rising Market: What You Need to Know Expert Guidance from Ash Buyers...

admin

September 26, 2025

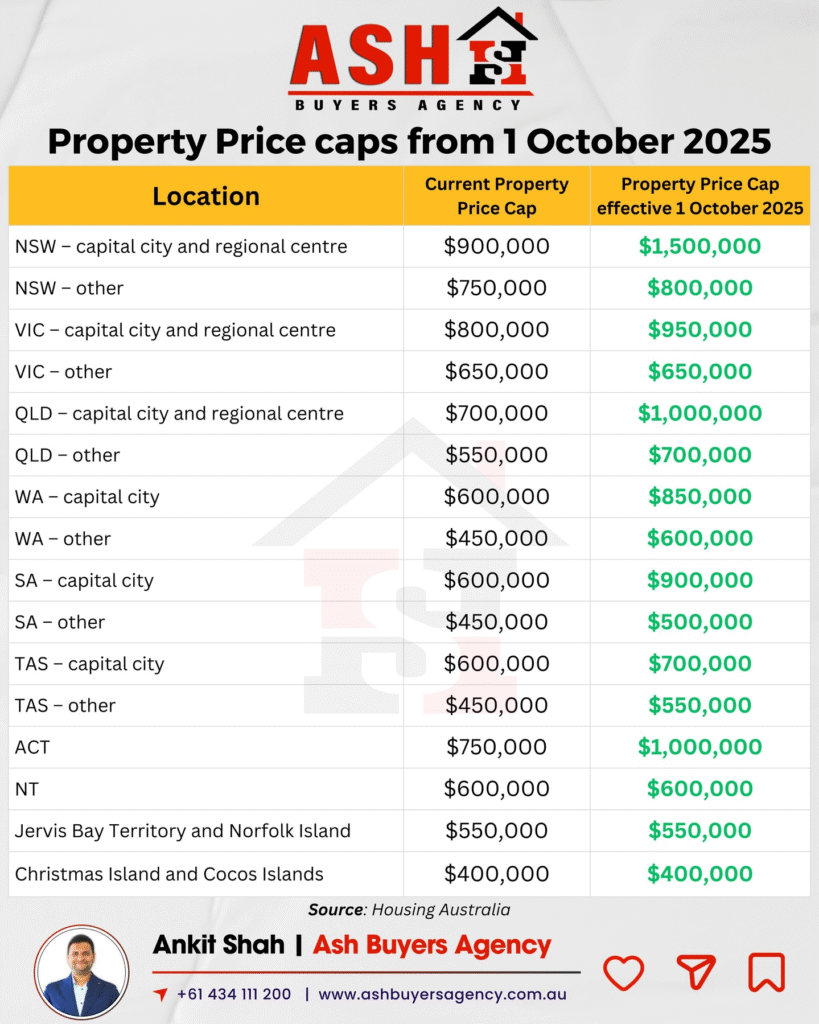

The Australian Government is expanding the Home Guarantee Scheme with unlimited places and higher property price caps, making it easier for more Australians to buy their first home sooner.

From 1 October 2025, the Scheme will remove caps on the number of Government guarantees available, allowing all eligible first home buyers to purchase a property with as little as a 5% deposit while avoiding Lenders Mortgage Insurance.

This expansion of the Home Guarantee Scheme delivers on the Government’s election commitment to help more Australians achieve home ownership.

The Home Guarantee Scheme will continue to be available nationwide through more than 30 Participating Lenders, including major banks, regional banks, and customer-owned banks.

From 1 October 2025, eligible first home buyers can apply for the Home Guarantee Scheme directly through one of the more than 30 Participating Lenders across Australia. This includes major banks, regional banks, and customer-owned banks.

To apply, you’ll need to:

The expansion of the Scheme is expected to have a noticeable impact on the property market:

Together, these changes are set to reshape the market from October 2025. For buyers, timing and strategy will be more important than ever.

For more information about the Scheme and to view our Frequently Asked Questions, please visit the Ash Buyers Agency.

For personalised guidance on navigating the Home Guarantee Scheme and securing your first home, reach out to Ash Buyers Agency. As your trusted Buyers Agent Sydney, we’re here to simplify the process and support you every step of the way. Call us today on +61 434 111 200 to get started.

Important: These changes will take effect from 1 October 2025. Until then, the Home Guarantee Scheme remains available to borrowers under the current eligibility criteria and price caps.

Follow us on Facebook and Instagram for updates on property price caps, expert buyer tips, and real stories of first home buyers achieving their dream of home ownership. You won’t want to miss it!

admin February 27, 2026 Buying Property in a Rising Market: What You Need to Know Expert Guidance from Ash Buyers...

admin February 23, 2026 Buying Off the Plan: A Smart Entry Strategy for First Home Buyers Stepping onto the property...

admin February 16, 2026 Why Thinking Long-Term Pays Off When Buying Property Many property buyers enter the market focused on...

Buying your first home or interstate investment might seem hard, but with Ash Buyers Agency, we make it easier. We help, educate and execute making the process simple and rewarding for our clients.

© 2026 · Ash Buyers Agency. All rights reserved. It is illegal to reproduce or distribute copyrighted material without the permission of the copyright owner.