Are You Chasing Your Mortgage Broker for Better Rates? Read This First

admin June 27, 2025 Are You Chasing Your Mortgage Broker for Better Rates? Read This First "Rate cuts are loud....

admin

February 18, 2025

The Reserve Bank of Australia (RBA) has delivered much-needed relief to homeowners and prospective buyers, cutting the cash rate from 4.35% to 4.10% on February 18, 2025. This marks the first rate cut in over four years, signaling a potential turning point for the property market, particularly in Sydney. The reduction not only eases financial strain on existing homeowners but also makes property ownership more attainable for new buyers.

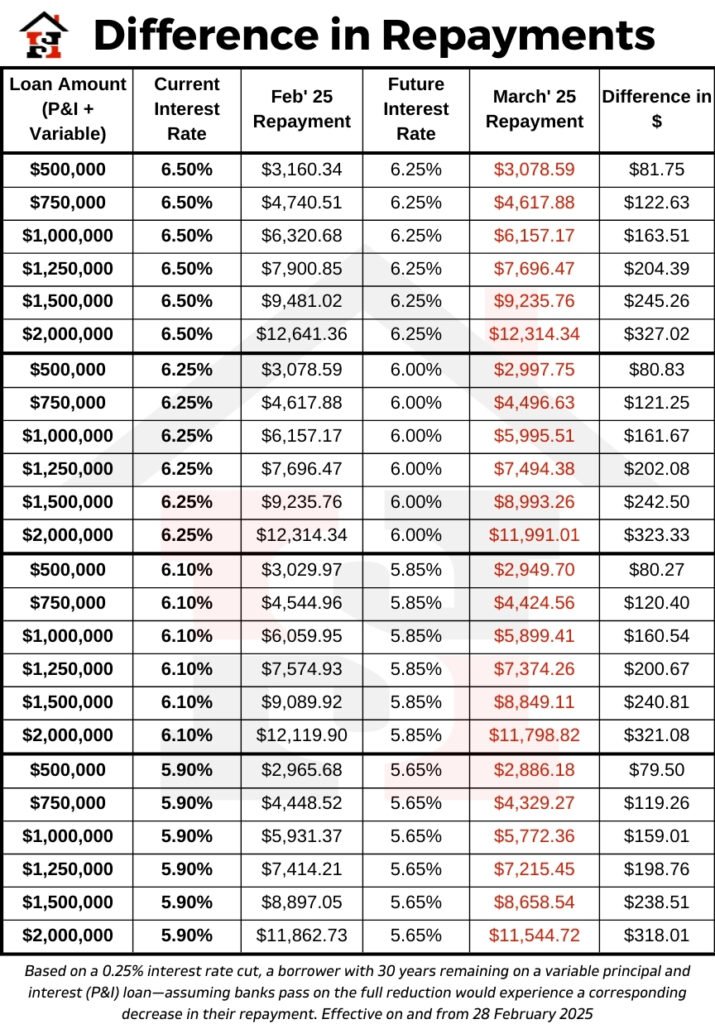

Lower Mortgage Repayments

For existing homeowners, the rate cut translates into immediate savings. With lower monthly payments, financial pressure eases, providing greater flexibility in managing household budgets. The extra savings can be directed toward other financial goals, such as home improvements, investments, or paying down debt faster. Reduced repayments also enhance overall affordability, making homeownership more sustainable in the long run.

Increased Borrowing Power

For prospective buyers, the rate cut means greater borrowing capacity. A single person earning an average full-time wage could potentially borrow an additional $12,000, opening up more property options that may have previously been out of reach.

Boosted Confidence and Market Activity

Lower rates often lead to renewed market confidence, encouraging hesitant buyers to enter the property market. This, in turn, stimulates demand, potentially increasing competition in key areas. Industry experts predict a vibrant autumn property market, with more buyers returning and transactions increasing.

Opportunities for Refinancing

Even those with fixed-rate mortgages may find this an ideal time to explore refinancing options. Lower interest rates could lead to significant long-term savings once a fixed-term loan matures.

Expert Insight

This rate cut is precisely what the property market needed,” says Angus Raine, Executive Chairman of Raine & Horne. “The pent-up demand we’ve been seeing since the end of 2024, combined with more affordable borrowing conditions provided by lower interest rates, will drive activity in the market this autumn.”

How Ash Buyers Agency Can Help

Navigating the Sydney property market amid changing interest rates requires expertise. At Ash Buyers Agency, Ankit Shah and our dedicated team provide tailored guidance to help you:

Find the right property that fits your budget and goals

Conclusion

The RBA’s decision to cut rates from 4.35% to 4.10% is a positive step towards improving affordability and boosting activity in the Sydney property market. If you’re considering buying a home, now is an opportune time to explore your options. Contact Ash Buyers Agency today to leverage our expertise and make your property ownership dreams a reality.

admin June 27, 2025 Are You Chasing Your Mortgage Broker for Better Rates? Read This First "Rate cuts are loud....

admin June 17, 2025 2025 Budget Boosts Help to Buy Scheme with Additional $800M: Big Win for First-Time Buyers For...

admin June 12, 2025 High Earners in Australia Are Renting More, Here’s Why It’s a Smart Move For decades, the...

Buying your first home or interstate investment might seem hard, but with Ash Buyers Agency, we make it easier. We help, educate and execute making the process simple and rewarding for our clients.

© 2025 · Ash Buyers Agency. All rights reserved. It is illegal to reproduce or distribute copyrighted material without the permission of the copyright owner.